Paying Foreign Individuals through Compass

If you would like to pay an honorarium, fees, award, or other payment to a foreign national (non-U.S. citizen), please visit the Global Support Program Fees and Honoraria page first for complete instructions. Also see Tax Assistance – Foreign Individuals and Entities page for information and the Finance Division Forms page for the Foreign Individual and Entity Payment Cheatsheet as well as links to Forms needed to be attached to the request.

If you are reimbursing expenses for a Foreign Individual who is not an Emory employee, please first review the Expense Reimbursements page for information on taxability of certain expense reimbursements. Also see Tax Assistance – Foreign Individuals and Entities page for information and the Finance Division Forms page for the Foreign Individual and Entity Payment Cheatsheet as well as links to Forms needed to be attached to the request.

If you are paying a foreign entity or individual where there was no travel to the U.S., please see the Foreign Source Payment Request Page for more information.

Payment Requests in Compass

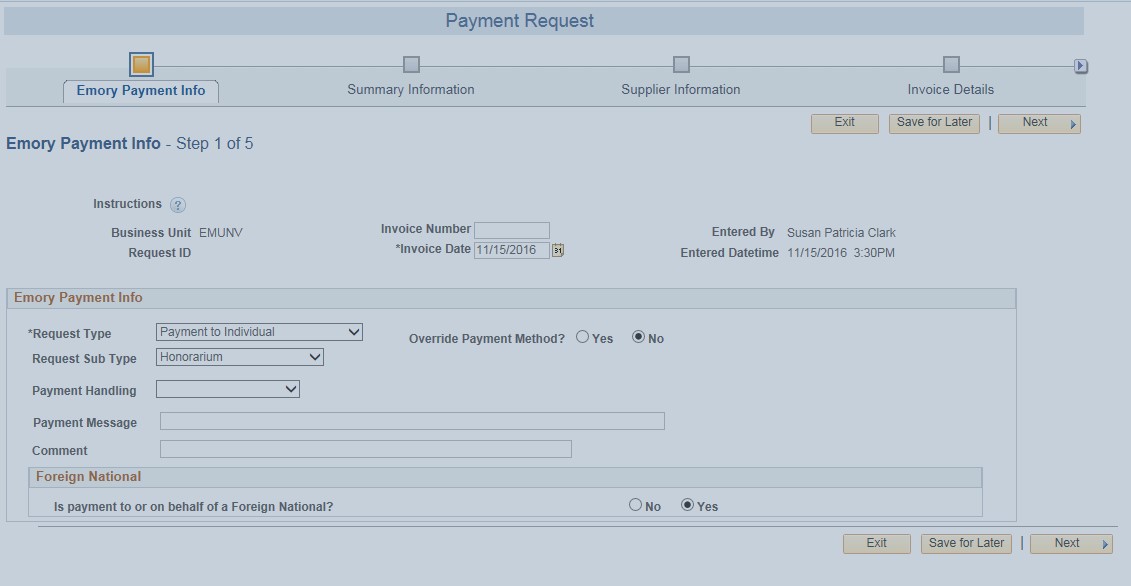

After originating your payment request in Compass, you will be prompted to answer one question regarding your visitor's tax residency status and two more follow-up questions, depending on how the first question is answered. The following information details how to answer those questions.

How to Answer the Compass NRA Questions for payments to individuals

Is this payment to or on behalf of a foreign national?

- If your visitor is a U.S. citizen, select No.

- If your visitor is not a U.S. citizen, select Yes, as shown in the following screen image:

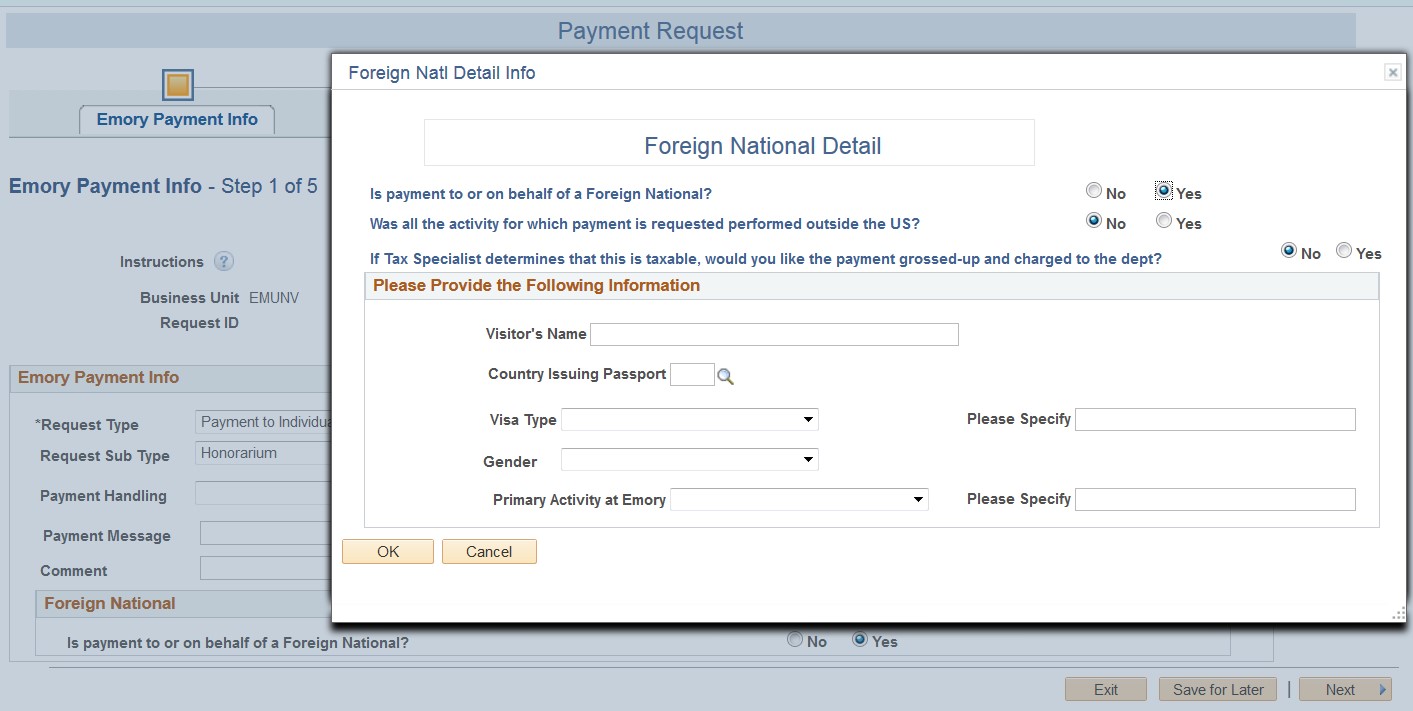

- If you selected Yes and your visitor is a permanent resident who meets the green card test, or if you can verify that your visitor is a resident alien for tax purposes based on the substantial presence test, select No for the next two questions and follow normal payment procedures through the Payment Request Center in Compass 9.2. You will have to at least put in a name in the Visitor’s name field to continue.

- For all other visitors' statuses (non-U.S. citizen), based on the substantial presence test, proceed to the next question and answer it as it relates to the visitor's situation.

Was all the activity for which payment is requested performed outside of the US?

- Check Yes if all the services provided for this payment took place entirely OUTSIDE of the United States, and follow the instructions for Payment Request for Foreign Source for what documentation needs to be attached to the request in Compass. Type in the recipients name in the information requested boxes.

- Check No if any of the services provided took place in the U.S. If No is checked to the foreign source question, the following question should be answered:

If the nonresident alien tax specialist determines that the payment is taxable, would you like the payment “grossed-up” and the tax charged to the department?

Generally, taxes are deducted from the gross payment amount. Occasionally, a department desires to cover the tax by grossing up the net payment desired by 42.9 percent (for 30% tax rates) or 16.28 percent (for 14% tax rates). Select No if the payee should pay the tax or Yes if the department will pay the tax. For more information regarding the "gross-up" calculation and for detailed instructions about which forms to include with your payment request, please refer to the Global Support Program site.

If the second question is answered yes, complete the information requested in Compass (Name, Country, Visa Type, etc).

For more information regarding special rules criteria for paying honoraria, fees, or expenses, please see the Special Rules Chart